Top AML KYC Service Provider

Best Anti Money Laundering Software

Cleversoft, a right solution for the right time.

Our financial crime prevention platform ensures compliance and reduces risk. With a holistic client risk profile view, PEP and sanctions screening, and tailored solutions for all company sizes, you can detect threats early and promptly avoid regulatory violations and damages.

A 360° Customer View

We believe in a 360-degree customer view collecting all relevant data in a centralized unit. This includes KYC, AML alert handling, Fraud, and Regulatory Cases. With the Financial Crime Prevention platform as your base, you can break down organizational silos.

To ensure maximum security, utilize a centralized system where each level has autonomy over their own tasks, creating a three-tiered defense system.

Discover our integrated approach to maintaining a fully compliant workflow and audit trail that secures and centralizes all data, based on W7 authorizations.

Services

1. Detect Fraud and AML Risks at an Early Stage: ForensicCloud Platform

ForensicCloud (cleversoft) is a cloud-based solution for managing cases that aid in detecting fraud, and AML risks early, enabling immediate action. Its features include real-time data analytics of network transactions and on-target monitoring of threats and transactions. In addition, its holistic view provides a quick and thorough understanding of your audit cases, thus preventing penalties and reputational harm.

Your benefits:

Case Management

- Automated and standardized processes to tackle all alerts and cases

- Complete workflow audit trail for increased accountability

- W7 Standard for consistent data interpretation

- Configurable retention policy

Data-driven Investigation

- Link analysis between alerts and cases, situational awareness, and actionable intelligence

- Robust visualization of complex risks via network diagrams and behavioral profiles

- Connectivity with internal data sources, official authorities, and registries

Reporting

- Customized home screen

- Comprehensive audit trail including logging of read actions in ForensicCloud

- KPI dashboard, standard letters, and reporting

- Extensive dashboard with to-do’s, action items, and journal

- Easy data management

- Preconfigured external reporting for authorities

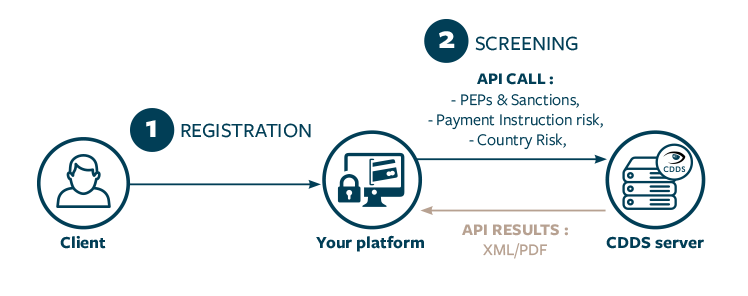

2. Integrate AML & KYC to Your Existing System with Management Program

The Cleversoft AML Risk API solution is a tool that can be integrated into your platform to help monitor and manage the risks associated with money laundering and terrorist financing. It allows for quick onboarding of clients and ongoing monitoring of their activities, including potential risks related to politically exposed persons (PEP), sanctions, law enforcement, country risk, and negative media coverage.

The advanced fuzzy matching algorithm allows you to search for partial names, typos, and phonetic variations. In addition, you can adjust the matching probability according to your risk tolerance.

Our API integrates with third-party software applications, including CRM, supply chain management, portfolio management, gaming, payment solutions, and any other software requiring a Sanction or PEP check.

How it works?

3. Reduce Fraud with All-in-one AML and CTF Solution

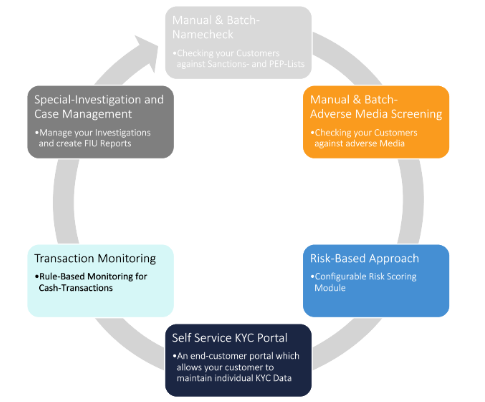

The cleverKYC platform makes it easier to identify false positives, generate detailed risk reports, and effectively manage fraud and money laundering risks in one convenient solution. The platform, meticulously crafted by experienced compliance professionals, caters to diverse industries. It undergoes regular assessments to align with ever-evolving regulatory frameworks and market trends.

cleverKYC has been customized to answer the requirements of Private Bank, Asset Manager, Insurance Company, Fund Services Provider, Corporate Service Providers, and Law Firms.

The software enables clients to manage their global AML/CTF risks and includes the following features:

- Identification and verification

- NameCheck against Sanctions lists, PEP, law enforcement with full coverage, and any personalized internal lists

- Automated risk rating calculation based on your risk matrix on natural persons, UBOs, and legal entities or our pre-configured model

- Client remediation

- Individual, detailed, and global reports

- Cash transaction monitoring

- Reporting engine for custom reports and more

4. Ease PEP and Sanction List Screening

With this service, you can perform a NameCheck on official sanctions lists and PEP lists and generate AML and MiFID risk profiles. You can access this service through the namecheck platform provided by PayPerClick. You can pay only for the required checks or subscribe for unlimited access.

- Speed

- PEP updates based on regular intervals and special events

- Sanction lists updated on next business day, especially important in the case of a special event.

- Quality

- Top-notch quality and near-time updates, minimizing false positives

- Leveraged over 700 global customers

- Majority customers are audited by BIG 4

- Completeness

- More than 180 Sanction lists

- PEP & Sanctions lists – global coverage

- Extended lists available